Unlocking the Potential of iTrustCapital: A Comprehensive Guide to Login, Account Setup, and Wealth Management

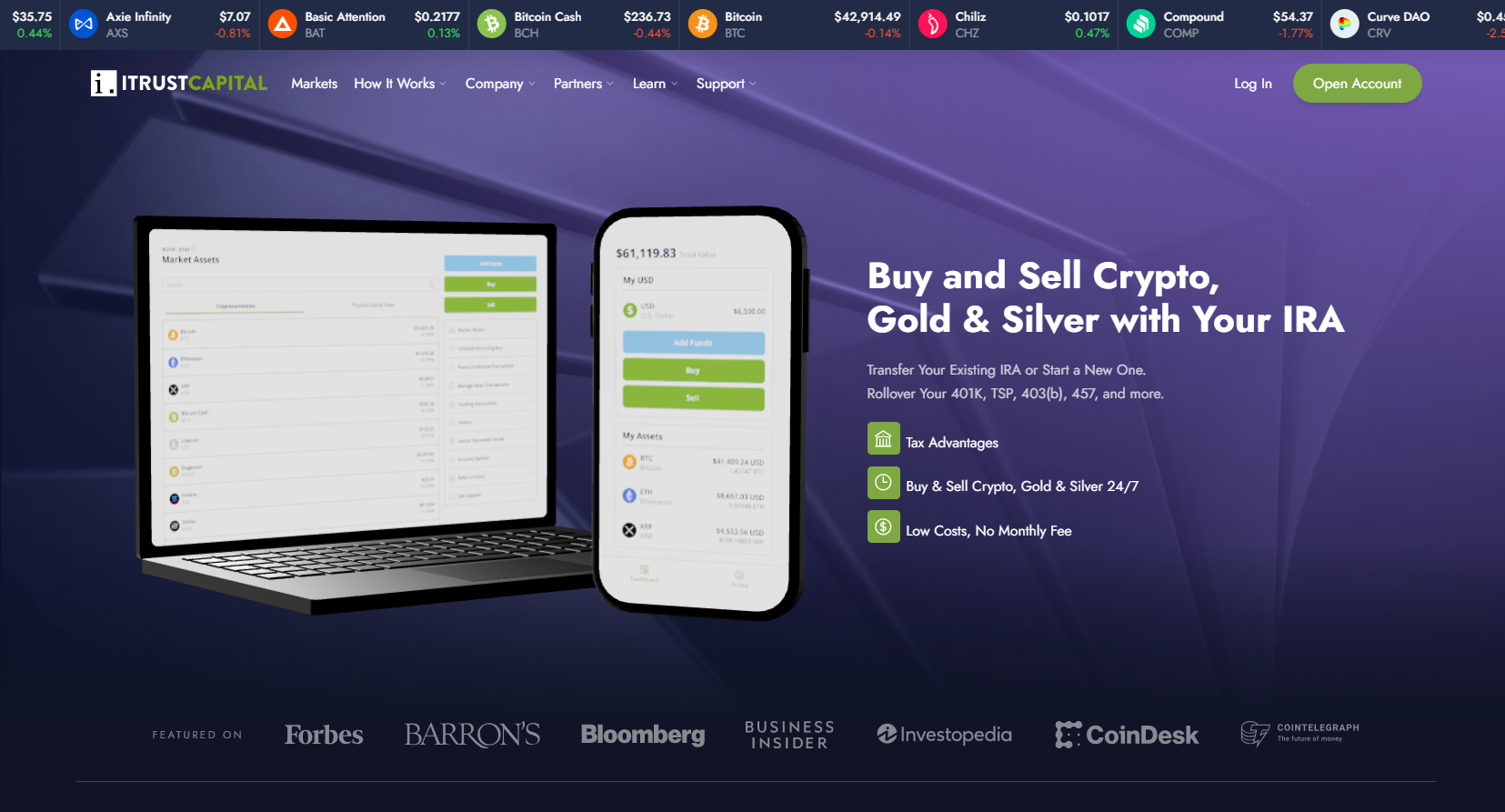

In today’s digital age, managing wealth has become more accessible than ever before. With the rise of innovative financial technology platforms, investors now have a myriad of options to grow and safeguard their assets. Among these platforms, iTrustCapital stands out as a leading provider of self-directed IRA and 401(k) accounts for cryptocurrency and precious metals investments. In this comprehensive guide, we delve into the intricacies of iTrustCapital, from the login process to setting up an account and effectively managing your wealth.

Introduction to iTrustCapital:

iTrustCapital is a fintech company that bridges the gap between traditional finance and the burgeoning world of digital assets. Founded in 2018, iTrustCapital has quickly gained recognition for its user-friendly interface, robust security measures, and diverse investment options. Whether you’re a seasoned investor or a novice exploring alternative assets, iTrustCapital offers a streamlined platform to achieve your financial goals.

Understanding the Significance of iTrustCapital Login:

The login process serves as the gateway to iTrustCapital’s suite of wealth management tools. To access your account, you’ll need to navigate to the iTrustCapital website or mobile app and enter your credentials. Security is paramount at iTrustCapital, so users can rest assured that their personal information and assets are protected through encryption and multi-factor authentication protocols.

Step-by-Step Guide to iTrustCapital Login:

- Visit the iTrustCapital Website or Mobile App: Begin by accessing the iTrustCapital platform through your preferred device – whether it’s a desktop computer, laptop, smartphone, or tablet.

- Enter Your Credentials: Input your username and password in the designated fields. For enhanced security, consider using a strong, unique password and enabling two-factor authentication.

- Authenticate Your Identity (if applicable): Depending on your account settings, you may be prompted to verify your identity through additional authentication methods, such as SMS codes or biometric recognition.

- Access Your Dashboard: Once logged in, you’ll gain access to your iTrustCapital dashboard, where you can view your portfolio, execute trades, and explore investment opportunities.

Setting Up Your iTrustCapital Account:

Creating an iTrustCapital account is a straightforward process that can be completed in a few simple steps:

- Registration: Begin by registering for an iTrustCapital account on their website or mobile app. You’ll need to provide basic personal information, such as your name, email address, and phone number.

- Verify Your Identity: To comply with regulatory requirements, iTrustCapital may request additional documentation to verify your identity. This typically involves uploading a government-issued ID, such as a driver’s license or passport, and proof of address.

- Fund Your Account: Once your identity is verified, you can fund your iTrustCapital account through a variety of methods, including bank transfers, wire transfers, or rollovers from existing retirement accounts.

- Select Your Investments: With funds in your account, you can start building your investment portfolio by choosing from a wide range of assets, including cryptocurrencies like Bitcoin and Ethereum, as well as precious metals such as gold and silver.

Maximizing Your Wealth with iTrustCapital:

Now that you’ve successfully logged in and set up your iTrustCapital account, it’s time to explore strategies for maximizing your wealth:

- Diversification: Take advantage of iTrustCapital’s diverse investment options to build a well-rounded portfolio that spans multiple asset classes. By diversifying your investments, you can mitigate risk and enhance long-term returns.

- Regular Contributions: Consider setting up recurring contributions to your iTrustCapital account to capitalize on dollar-cost averaging. By investing a fixed amount at regular intervals, you can smooth out market volatility and accumulate assets over time.

- Stay Informed: Keep abreast of market trends, news, and developments that may impact your investment strategy. iTrustCapital provides access to educational resources, market analysis, and expert insights to help you make informed decisions.

- Rebalancing: Periodically review and rebalance your portfolio to ensure that it remains aligned with your financial goals and risk tolerance. Adjust your asset allocation as needed to capitalize on emerging opportunities or mitigate potential losses.

Conclusion:

iTrustCapital offers investors a powerful platform to unlock the potential of alternative assets and build wealth for the future. By following the steps outlined in this guide, you can seamlessly navigate the login process, set up your account, and embark on a journey toward financial success. Whether you’re interested in cryptocurrencies, precious metals, or traditional assets, iTrustCapital provides the tools and resources you need to thrive in today’s dynamic market landscape. Start your wealth-building journey with iTrustCapital today and take control of your financial future.